Alibaba has set another Single’s Day record after the e-commerce giant sold over $25 billion of product on the Chinese biggest online shopping date.

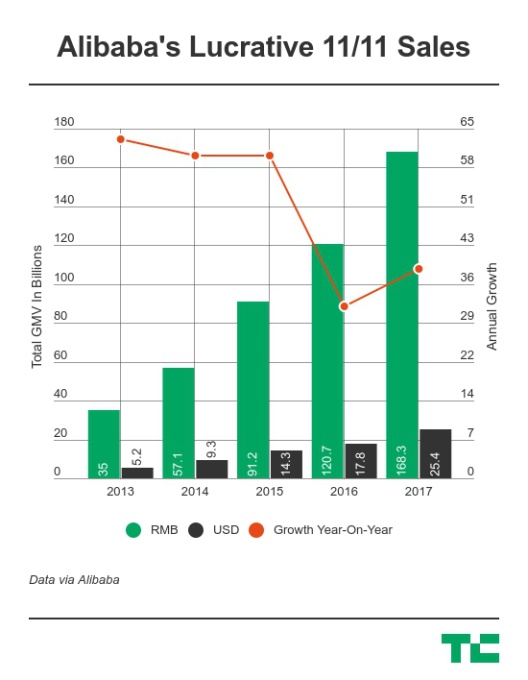

The full number comes in at 163.8 billion RMB, that’s roughly $25.3 billion, in GMV — that’s “gross merchandise volume” which is used to measure a dollar value for all sales on a platform. In Alibaba’s case, that predominantly means its Taobao marketplace and Tmall brand store although it does offer sales via its international services and it ships worldwide. All told, Alibaba handled 1.48 Billion transactions during the 24-hour period.

That represents an impressive 39 percent increase on last year’s sales total of RMB 120.7 billion ($17.79 billion), and it comes nicely on the heels of another blockbuster quarter in which Alibaba’s revenue surged by 61 percent thanks to its core business in China.

For comparison, Alibaba’s Single’s Day haul puts America’s largest shopping days in the corner. Retailers pulled in a record $3 billion on Black Friday and then $3.45 billion on Cyber Monday, both of which were records.

#Double11 2017: As of 24:00, total GMV has exceeded RMB168.2 billion – more than USD25.3 billion. Mobile GMV: 90%. pic.twitter.com/Kfm3dhNNdw

— Alibaba Group (@AlibabaGroup) November 11, 2017

The year’s numbers also signal a return to growth for Single’s Day (11/11) sales, an important area that investors will look at and Alibaba needs to show progress on.

While the jump isn’t as much as the 60 percent Alibaba saw yearly from from 2013 to 2015, it is up on last year’s 32 percent which is impressive given the scale that the event has reached today and the growth that Alibaba’s business has seen since then.

The holiday began as a promotion for TMall started by current CEO Daniel Zhang, who was then in charge of the business unit, as a way to make single people feel less lonely, but it has since blossomed into the world’s largest single shopping date by some margin.

GMV is off the charts, but it is important to note that this is not revenue for Alibaba. The company makes money from e-commerce in two main ways. It charges a commission and ‘store fee’ to brands that are accepted to Tmall; Taobao doesn’t charge fees to merchants, it instead makes money by charging them for ads that boost their product/store visibility.

It’s important to note sales in RMB and USD due to varying exchange rates

This year’s 11/11 got off to a fast start with around $7 billion of goods sold in the first 30 minutes of the day alone. Alibaba went on to surpass last year’s $18 billion total after just twelve hours of sales.

Another important metric is mobile. Not only does a higher number mean that Alibaba is reaching new/newish internet users, but mobile users tend to be more engaged which is obviously an important goal.

This year, Alibaba said 90 percent of sales were made on mobile which is up on 82 percent for 2016 and 69 percent in 2015.

Among the many stats released by Alibaba, the following stand out:

- Order total numbers hit 812 million, up 23 percent

- Alibaba Cloud, which handled the infrastructure, managed 325,000 orders at peak

- Alipay processed 1.5 billion payment transactions, up 41 percent

- Over 140,000 brands — including 60,000 international — took part on Tmall where they offered 15 million product listings

- 167 merchants generated over 100 million RMB ($15.1 million) in sales each

- 17 merchants surpassed 500 million RMB ($75.4 million) each

- Six merchants surpassed 1 billion RMB ($150.9 million) each